Market Leader in Private Credit

KBRA brings a unique lens to the evolving Private Credit landscape, delivering sharp insights through deep research, dynamic webinars, and rigorous rating analysis.

Recurring Revenue Loan Metrics Dashboard: Q2 2025

In this report, an update to our Q1 analysis, KBRA continues to track and present several key metrics in a dashboard format, sourced from quarterly collateral loan tapes provided by the issuers of KBRA-rated recurring revenue loan (RRL) asset-backed securities (ABS). This update incorporates collateral tapes dated as of June 2025. For more details on scope and metrics definitions.

View ReportExpanding Use of Ratings in Private Credit

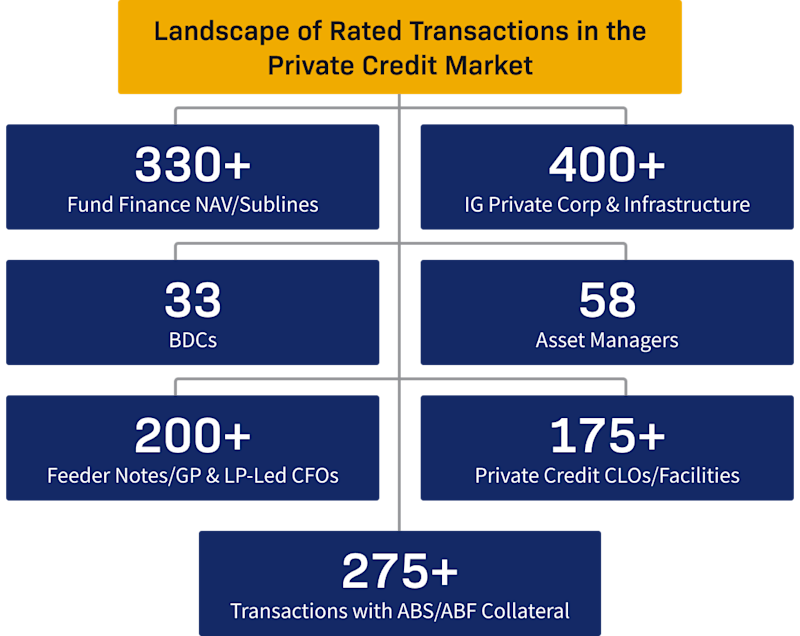

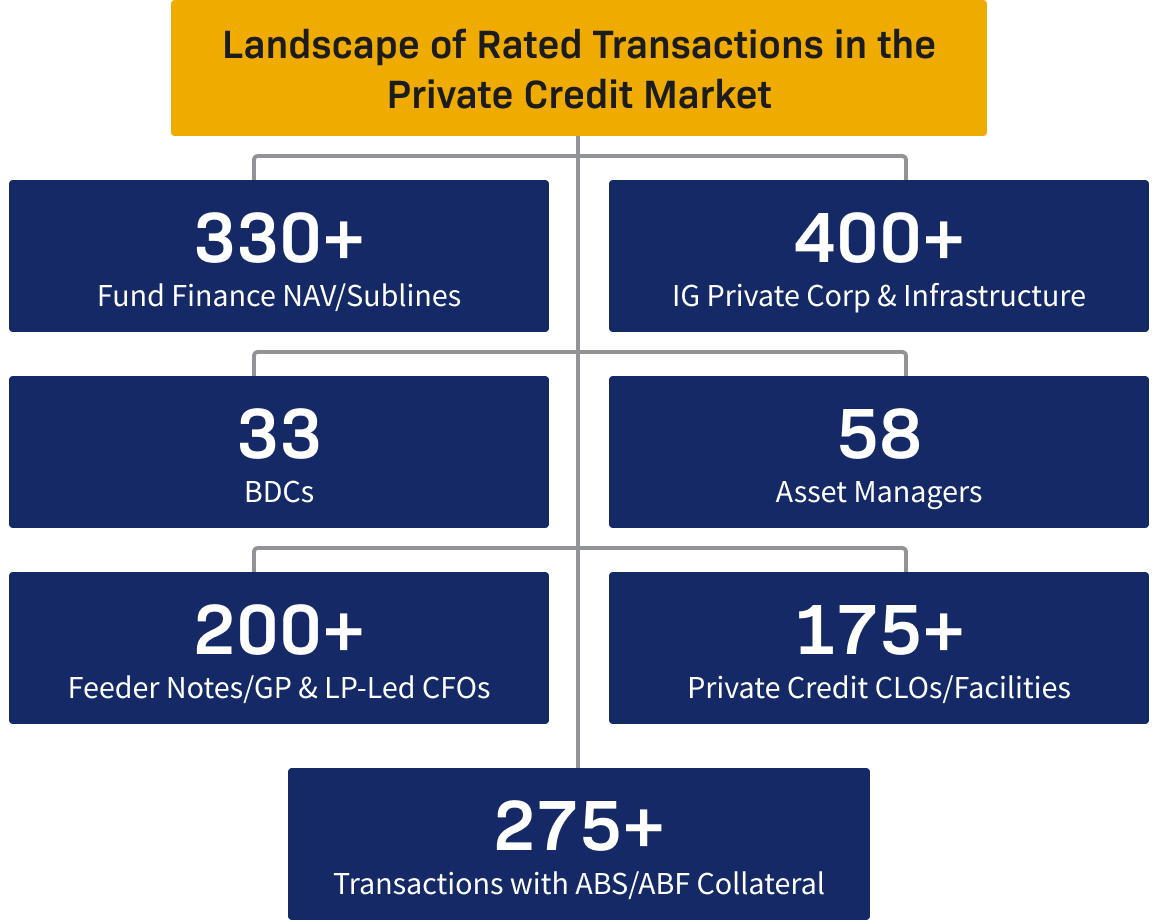

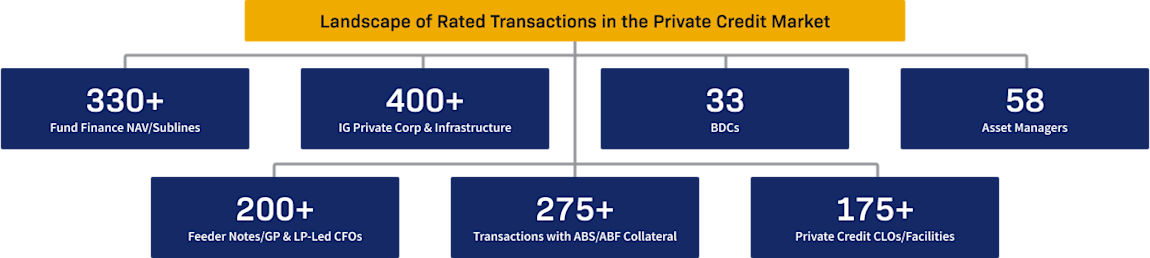

KBRA has over 1,000 ratings of transactions and issuers within the private capital universe and has worked with over 100 sponsors.

Performed 3,500+ underlying credit assessments on middle market sponsor-backed companies in 2024

Latest Private Credit Research

Recurring Revenue Loan Metrics Dashboard: Q2 2025

In this report, an update to our Q1 analysis, KBRA continues to track and present several key metrics in a dashboard format, sourced from quarterly collateral loan tapes provided by the issuers of KBRA-rated recurring revenue loan (RRL) asset-backed securities (ABS). This update incorporates collateral tapes dated as of June 2025. For more details on scope and metrics definitions.

A Breakout Year for Rated Note Feeders and CFOs

Rated note feeders (RNF) and collateralized fund obligations (CFO) have gained significant momentum in 2025, already breaking all other issuance records. The growth reflects strong adoption from investors as an effective yet customizable way to access alternative assets and for alternative asset managers (AAM) as viable fundraising tools.

Business Development Company (BDC) Ratings Compendium: Second-Quarter 2025

In this quarter’s Compendium, KBRA reviews the financial performance of KBRA-rated BDCs in a competitive environment characterized by tighter spreads, elevated repayment activity in the upper middle market—driven by strength in the broadly syndicated loan (BSL) market—solid but slowing capital formation, and a modest pickup in mergers and acquisitions (M&A) activity.

Making the Best of 401(k) Democratization

President Donald Trump on August 7 signed an executive order to potentially ease regulatory barriers that have limited defined contribution (DC) retirement plans’ access to alternative investments—a move that could allow millions of retirement savers to invest in an expansive list of such assets

Q2 2025 Middle Market Borrower Surveillance Compendium—Waiting for Godot

Private credit may well be in a “Waiting for Godot” moment—marked by growing anticipation of some unknown reckoning that continues to be deferred. As the industry continues to adapt to various market uncertainties, KBRA notes signs of improving credit quality for some borrowers, while still observing a subset of borrowers …

How KBRA Ratings Stack Up

Once considered a niche market, private credit securitizations1 have become a core element of the structured finance (SF) landscape, particularly within the asset-backed securities (ABS) and structured credit (SC) sectors. Since 2022, approximately 20% of all KBRA-rated SF transactions have been privately placed. The shar…

Webinars & Podcasts

3 Things in Credit Podcast: Inflection Point, Ares’ Perspective, and Maersk’s Beat

Policy Pulse: The International Association of Insurance Supervisors (IAIS) and Alternative Assets

KBRA's Emilie Nadler and Ryan Mensing discuss the IAIS Draft Paper on life insurers’ growing exposure to private credit and AIR deals, and walk through KBRA’s comment letter highlighting our insights as a leader in the private credit space.

Minority Interests and JV Structures—Through the Looking Glass

This webinar examines how minority-stake JV structures are being used not only to monetize assets but also to finance acquisitions. We explore the implications of these structures for creditors and rated debt, and how KBRA assesses default and recovery risk in such transactions. Key sectors, structural features, and rating drivers behind more than $30 billion in rated issuance are discussed.

BDC Performance Update & 2025 Outlook

Listen to KBRA's Financial Institutions experts as they provide their market insights and expectations regarding BDC performance in 2025.

KBRA’s expectation for 2025 financial results

Portfolio quality and how BDCs are holding up

Liquidity and funding update

News and Recognition

Secondaries Set to be Main Beneficiary of 401(k) Inclusion

KBRA Warns 401(k) Order Could Create a Bubble of Capital

Bond Analysts See Pros and Cons of Alternatives in 401(k)s

Default Warnings Start to Pile Up in Private Credit Market

Trump's 401(k) Change: What Administrators and Employees Need to Know

KBRA Shortlisted for the Private Equity Wire's US 2025 "Credit Rating Agency of the Year" Award

Analytical Contacts

William Cox

Eric Neglia

Thomas Speller

Andrew Giudici

Eric Hudson

Sean Malone

Joe Scott

Teri Seelig

Shane Olaleye

John Sage

Business Development

Dana Bunting

Jason Lilien

Mauricio Noé

Constantine Schidlovsky

Anna Nolan